Page 34 - DEBKVOL-1

P. 34

2.6 Double Entry Book Keeping—CBSE XII

24. No partner shall without the consent of the other partners—

(i) Engage in any other business that is similar to the business carried on by the firm, directly

or indirectly;

(ii) Enter into partnership on behalf of the firm.

25. That the terms of the Partnership Deed may be altered by the written consent of the Parties to this DEED.

26. That in the case of any dispute arising out of this DEED between the Parties of this DEED, it shall be decided

by Arbitration as provided for under the Indian Arbitration Act, 1996.

27. That the other matters for which no provision is made in this DEED, shall be decided upon by the majority

of the partners for the time being of the partnership.

28. The terms and conditions not specifically given in this DEED will be termed as per the provisions of the

Indian Partnership Act, 1932.

IN WITNESS WHEREOF the Parties hereto have set and subscribed their respective hands to these presents the

day, month and year first written above.

WITNESSES SIGNATURES OF PARTNERS

1. _________________ Deepali

(Party of the First Part)

2. _________________ Manju

(Party of the Second Part)

Solved Questions

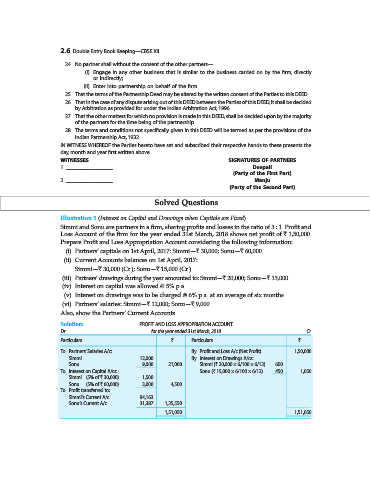

Illustration 1 (Interest on Capital and Drawings when Capitals are Fixed).

Simmi and Sonu are partners in a firm, sharing profits and losses in the ratio of 3 : 1. Profit and

Loss Account of the firm for the year ended 31st March, 2018 shows net profit of ` 1,50,000.

Prepare Profit and Loss Appropriation Account considering the following information:

(i) Partners’ capitals on 1st April, 2017: Simmi—` 30,000; Sonu—` 60,000.

(ii) Current Accounts balances on 1st April, 2017:

Simmi—` 30,000 (Cr.); Sonu—` 15,000 (Cr.).

(iii) Partners’ drawings during the year amounted to: Simmi—` 20,000; Sonu—` 15,000.

(iv) Interest on capital was allowed @ 5% p.a.

(v) Interest on drawings was to be charged @ 6% p.a. at an average of six months.

(vi) Partners’ salaries: Simmi—` 12,000; Sonu—` 9,000.

Also, show the Partners’ Current Accounts.

Solution: PROFIT AND LOSS APPROPRIATION ACCOUNT

Dr. for the year ended 31st March, 2018 Cr.

Particulars ` Particulars `

To Partners’ Salaries A/c: By Profit and Loss A/c (Net Profit) 1,50,000

Simmi 12,000 By Interest on Drawings A/cs:

Sonu 9,000 21,000 Simmi (` 20,000 × 6/100 × 6/12) 600

To Interest on Capital A/cs: Sonu (` 15,000 × 6/100 × 6/12) 450 1,050

Simmi (5% of ` 30,000) 1,500

Sonu (5% of ` 60,000) 3,000 4,500

To Profit transferred to:

Simmi’s Current A/c 94,163

Sonu’s Current A/c 31,387 1,25,550

1,51,050 1,51,050