Page 79 - DEBK11

P. 79

CHAPTER Accounting of Goods

CHAPTER

12 and Services Tax (GST)

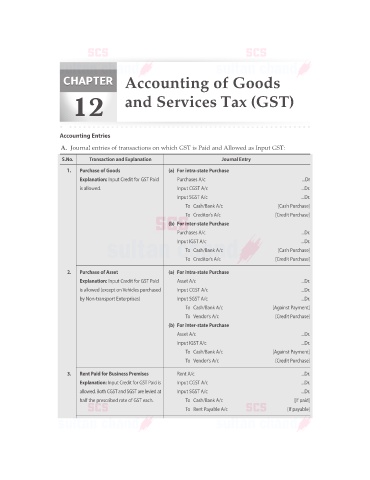

Accounting Entries

A. Journal entries of transactions on which GST is Paid and Allowed as Input GST:

S.No. Transaction and Explanation Journal Entry

1. Purchase of Goods (a) For intra-state Purchase

Explanation: Input Credit for GST Paid Purchases A/c ...Dr

is allowed. Input CGST A/c ...Dr.

Input SGST A/c ...Dr.

To Cash/Bank A/c [Cash Purchase]

To Creditor’s A/c [Credit Purchase]

(b) For inter-state Purchase

Purchases A/c ...Dr.

Input IGST A/c ...Dr.

To Cash/Bank A/c [Cash Purchase]

To Creditor’s A/c [Credit Purchase]

2. Purchase of Asset (a) For intra-state Purchase

Explanation: Input Credit for GST Paid Asset A/c ...Dr.

is allowed (except on Vehicles purchased Input CGST A/c ...Dr.

by Non-transport Enterprises) Input SGST A/c ...Dr.

To Cash/Bank A/c [Against Payment]

To Vendor’s A/c [Credit Purchase]

(b) For inter-state Purchase

Asset A/c ...Dr.

Input IGST A/c ...Dr.

To Cash/Bank A/c [Against Payment]

To Vendor’s A/c [Credit Purchase]

3. Rent Paid for Business Premises Rent A/c ...Dr.

Explanation: Input Credit for GST Paid is Input CGST A/c ...Dr.

allowed. Both CGST and SGST are levied at Input SGST A/c ...Dr.

half the prescribed rate of GST each. To Cash/Bank A/c [If paid]

To Rent Payable A/c [If payable]