Page 75 - ISCDEBK-12

P. 75

4.2 Double Entry Book Keeping (Section A)—ISC XII

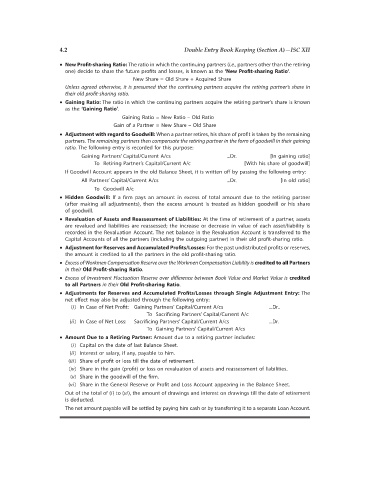

• New Profit-sharing Ratio: The ratio in which the continuing partners (i.e., partners other than the retiring

one) decide to share the future profits and losses, is known as the ‘New Profit-sharing Ratio’.

New Share = Old Share + Acquired Share

Unless agreed otherwise, it is presumed that the continuing partners acquire the retiring partner’s share in

their old profit-sharing ratio.

• Gaining Ratio: The ratio in which the continuing partners acquire the retiring partner’s share is known

as the ‘Gaining Ratio’.

Gaining Ratio = New Ratio – Old Ratio

Gain of a Partner = New Share – Old Share

• Adjustment with regard to Goodwill: When a partner retires, his share of profit is taken by the remaining

partners. The remaining partners then compensate the retiring partner in the form of goodwill in their gaining

ratio. The following entry is recorded for this purpose:

Gaining Partners’ Capital/Current A/cs ...Dr. [In gaining ratio]

To Retiring Partner’s Capital/Current A/c [With his share of goodwill]

If Goodwill Account appears in the old Balance Sheet, it is written off by passing the following entry:

All Partners’ Capital/Current A/cs ...Dr. [In old ratio]

To Goodwill A/c

• Hidden Goodwill: If a firm pays an amount in excess of total amount due to the retiring partner

(after making all adjustments), then the excess amount is treated as hidden goodwill or his share

of goodwill.

• Revaluation of Assets and Reassessment of Liabilities: At the time of retirement of a partner, assets

are revalued and liabilities are reassessed; the increase or decrease in value of each asset/liability is

recorded in the Revaluation Account. The net balance in the Revaluation Account is transferred to the

Capital Accounts of all the partners (including the outgoing partner) in their old profit-sharing ratio.

• Adjustment for Reserves and Accumulated Profits/Losses: For the past undistributed profits or reserves,

the amount is credited to all the partners in the old profit-sharing ratio.

• Excess of Workmen Compensation Reserve over the Workmen Compensation Liability is credited to all Partners

in their Old Profit-sharing Ratio.

• Excess of Investment Fluctuation Reserve over difference between Book Value and Market Value is credited

to all Partners in their Old Profit-sharing Ratio.

• Adjustments for Reserves and Accumulated Profits/Losses through Single Adjustment Entry: The

net effect may also be adjusted through the following entry:

(i) In Case of Net Profit: Gaining Partners’ Capital/Current A/cs ...Dr..

To Sacrificing Partners’ Capital/Current A/c

(ii) In Case of Net Loss: Sacrificing Partners’ Capital/Current A/cs ...Dr.

To Gaining Partners’ Capital/Current A/cs

• Amount Due to a Retiring Partner: Amount due to a retiring partner includes:

(i) Capital on the date of last Balance Sheet.

(ii) Interest or salary, if any, payable to him.

(iii) Share of profit or loss till the date of retirement.

(iv) Share in the gain (profit) or loss on revaluation of assets and reassessment of liabilities.

(v) Share in the goodwill of the firm.

(vi) Share in the General Reserve or Profit and Loss Account appearing in the Balance Sheet.

Out of the total of (i) to (vi), the amount of drawings and interest on drawings till the date of retirement

is deducted.

The net amount payable will be settled by paying him cash or by transferring it to a separate Loan Account.