Page 47 - MA12

P. 47

3.22 Management Accounting (Section B)—ISC XII

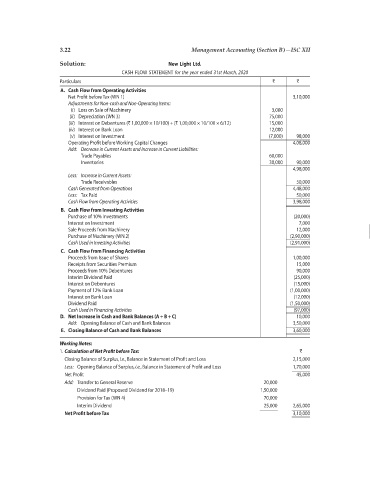

Solution: New Light Ltd.

CASH FLOW STATEMENT for the year ended 31st March, 2020

Particulars ` `

A. Cash Flow from Operating Activities

Net Profit before Tax (WN 1) 3,10,000

Adjustments for Non-cash and Non-Operating Items:

(i) Loss on Sale of Machinery 3,000

(ii) Depreciation (WN 3) 75,000

(iii) Interest on Debentures (` 1,00,000 × 10/100) + (` 1,00,000 × 10/100 × 6/12) 15,000

(iv) Interest on Bank Loan 12,000

(v) Interest on Investment (7,000) 98,000

Operating Profit before Working Capital Changes 4,08,000

Add: Decrease in Current Assets and Increase in Current Liabilities:

Trade Payables 60,000

Inventories 30,000 90,000

4,98,000

Less: Increase in Current Assets:

Trade Receivables 50,000

Cash Generated from Operations 4,48,000

Less: Tax Paid 50,000

Cash Flow from Operating Activities 3,98,000

B. Cash Flow from Investing Activities

Purchase of 10% Investments (20,000)

Interest on Investment 7,000

Sale Proceeds from Machinery 12,000

Purchase of Machinery (WN 2) (2,90,000)

Cash Used in Investing Activities (2,91,000)

C. Cash Flow from Financing Activities

Proceeds from Issue of Shares 1,00,000

Receipts from Securities Premium 15,000

Proceeds from 10% Debentures 90,000

Interim Dividend Paid (25,000)

Interest on Debentures (15,000)

Payment of 12% Bank Loan (1,00,000)

Interest on Bank Loan (12,000)

Dividend Paid (1,50,000)

Cash Used in Financing Activities (97,000)

D. Net Increase in Cash and Bank Balances (A + B + C) 10,000

Add: Opening Balance of Cash and Bank Balances 3,50,000

E. Closing Balance of Cash and Bank Balances 3,60,000

Working Notes:

1. Calculation of Net Profit before Tax: `

Closing Balance of Surplus, i.e., Balance in Statement of Profit and Loss 2,15,000

Less: Opening Balance of Surplus, i.e., Balance in Statement of Profit and Loss 1,70,000

Net Profit 45,000

Add: Transfer to General Reserve 20,000

Dividend Paid (Proposed Dividend for 2018–19) 1,50,000

Provision for Tax (WN 4) 70,000

Interim Dividend 25,000 2,65,000

Net Profit before Tax 3,10,000