Page 86 - DEBK11

P. 86

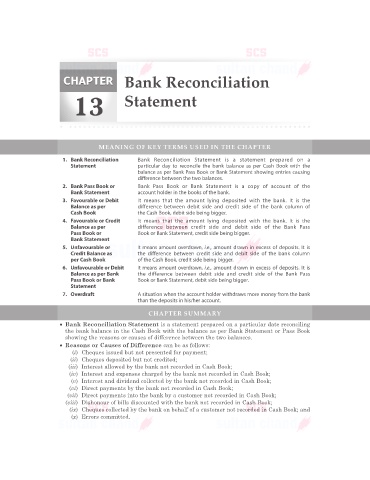

CHAPTER Bank Reconciliation

CHAPTER

13 Statement

MEANING OF KEY TERMS USED IN THE CHAPTER

1. Bank Reconciliation Bank Reconciliation Statement is a statement prepared on a

Statement particular day to reconcile the bank balance as per Cash Book with the

balance as per Bank Pass Book or Bank Statement showing entries causing

difference between the two balances.

2. Bank Pass Book or Bank Pass Book or Bank Statement is a copy of account of the

Bank Statement account holder in the books of the bank.

3. Favourable or Debit It means that the amount lying deposited with the bank. It is the

Balance as per difference between debit side and credit side of the bank column of

Cash Book the Cash Book, debit side being bigger.

4. Favourable or Credit It means that the amount lying deposited with the bank. It is the

Balance as per difference between credit side and debit side of the Bank Pass

Pass Book or Book or Bank Statement, credit side being bigger.

Bank Statement

5. Unfavourable or It means amount overdrawn, i.e., amount drawn in excess of deposits. It is

Credit Balance as the difference between credit side and debit side of the bank column

per Cash Book of the Cash Book, credit side being bigger.

6. Unfavourable or Debit It means amount overdrawn, i.e., amount drawn in excess of deposits. It is

Balance as per Bank the difference between debit side and credit side of the Bank Pass

Pass Book or Bank Book or Bank Statement, debit side being bigger.

Statement

7. Overdraft A situation when the account holder withdraws more money from the bank

than the deposits in his/her account.

CHAPTER SUMMARY

• Bank Reconciliation Statement is a statement prepared on a particular date reconciling

the bank balance in the Cash Book with the balance as per Bank Statement or Pass Book

showing the reasons or causes of difference between the two balances.

• Reasons or Causes of Difference can be as follows:

(i) Cheques issued but not presented for payment;

(ii) Cheques deposited but not credited;

(iii) Interest allowed by the bank not recorded in Cash Book;

(iv) Interest and expenses charged by the bank not recorded in Cash Book;

(v) Interest and dividend collected by the bank not recorded in Cash Book;

(vi) Direct payments by the bank not recorded in Cash Book;

(vii) Direct payments into the bank by a customer not recorded in Cash Book;

(viii) Dishonour of bills discounted with the bank not recorded in Cash Book;

(ix) Cheques collected by the bank on behalf of a customer not recorded in Cash Book; and

(x) Errors committed.