Page 71 - MA-12

P. 71

4

C H A P T E R

Retirement and Death of a Partner

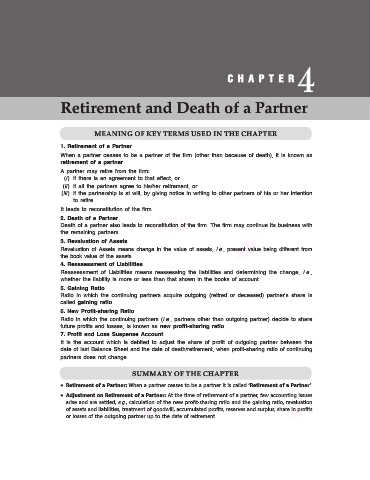

MEANING OF KEY TERMS USED IN THE CHAPTER

1. Retirement of a Partner

When a partner ceases to be a partner of the firm (other than because of death), it is known as

retirement of a partner.

A partner may retire from the firm:

(i) if there is an agreement to that effect, or

(ii) if all the partners agree to his/her retirement, or

(iii) if the partnership is at will, by giving notice in writing to other partners of his or her intention

to retire.

It leads to reconstitution of the firm.

2. Death of a Partner

Death of a partner also leads to reconstitution of the firm. The firm may continue its business with

the remaining partners.

3. Revaluation of Assets

Revaluation of Assets means change in the value of assets, i.e., present value being different from

the book value of the assets.

4. Reassessment of Liabilities

Reassessment of Liabilities means reassessing the liabilities and determining the change, i.e.,

whether the liability is more or less than that shown in the books of account.

5. Gaining Ratio

Ratio in which the continuing partners acquire outgoing (retired or deceased) partner’s share is

called gaining ratio.

6. New Profit-sharing Ratio

Ratio in which the continuing partners (i.e., partners other than outgoing partner) decide to share

future profits and losses, is known as new profit-sharing ratio.

7. Profit and Loss Suspense Account

It is the account which is debited to adjust the share of profit of outgoing partner between the

date of last Balance Sheet and the date of death/retirement, when profit-sharing ratio of continuing

partners does not change.

SUMMARY OF THE CHAPTER

• Retirement of a Partner: When a partner ceases to be a partner it is called ‘Retirement of a Partner’.

• Adjustment on Retirement of a Partner: At the time of retirement of a partner, few accounting issues

arise and are settled, e.g., calculation of the new profit-sharing ratio and the gaining ratio, revaluation

of assets and liabilities, treatment of goodwill, accumulated profits, reserves and surplus, share in profits

or losses of the outgoing partner up to the date of retirement.