Page 34 - DEBK11

P. 34

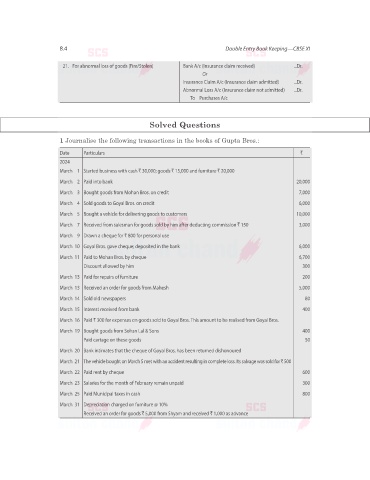

8.4 Double Entry Book Keeping—CBSE XI

21. For abnormal loss of goods (Fire/Stolen) Bank A/c (Insurance claim received) ...Dr.

Or

Insurance Claim A/c (Insurance claim admitted) ...Dr.

Abnormal Loss A/c (Insurance claim not admitted) ...Dr.

To Purchases A/c

Solved Questions

1 Journalise the following transactions in the books of Gupta Bros.:

Date Particulars `

2025

March 1 Started business with cash ` 30,000; goods ` 15,000 and furniture ` 20,000

March 2 Paid into bank 20,000

March 3 Bought goods from Mohan Bros. on credit 7,000

March 4 Sold goods to Goyal Bros. on credit 6,000

March 5 Bought a vehicle for delivering goods to customers 10,000

March 7 Received from salesman for goods sold by him after deducting commission ` 150 3,000

March 9 Drawn a cheque for ` 800 for personal use

March 10 Goyal Bros. gave cheque; deposited in the bank 6,000

March 11 Paid to Mohan Bros. by cheque 6,700

Discount allowed by him 300

March 13 Paid for repairs of furniture 200

March 13 Received an order for goods from Mahesh 5,000

March 14 Sold old newspapers 80

March 15 Interest received from bank 400

March 16 Paid ` 300 for expenses on goods sold to Goyal Bros. This amount to be realised from Goyal Bros.

March 19 Bought goods from Sohan Lal & Sons 400

Paid cartage on these goods 50

March 20 Bank intimates that the cheque of Goyal Bros. has been returned dishonoured

March 21 The vehicle bought on March 5 met with an accident resulting in complete loss. Its salvage was sold for ` 500

March 22 Paid rent by cheque 600

March 23 Salaries for the month of February remain unpaid 300

March 25 Paid Municipal taxes in cash 800

March 31 Depreciation charged on furniture @ 10%

Received an order for goods ` 5,000 from Shyam and received ` 1,000 as advance